iowa capital gains tax farmland

Short-term capital gains apply if youve owned. Capital Gains Questions on Selling Farmland 1 day ago Jul 16 2013 They have a gain from selling farmland of 200000.

Farmland Market Outlook For 2022 From An Iowa Auctioneer

The deduction must be reported on one of six forms by completing the applicable Capital Gain.

. If a property is held beyond a year capital gains are taxed at a rate of 15 or 20 in addition to. The tax rate on most net capital gain is no higher than 15 for. The Legislative Services Agency estimated the farm capital gains tax exemption will cost the state an estimated 72 million in fiscal year 2024.

42000 of the gain would be taxed at zero percent 72000. The Legislative Services Agency estimated the farm capital gains tax exemption will cost the state an estimated 72 million in fiscal year 2024. Kim Reynolds signed a 39 flat tax on March 1 which will roll back taxes for many farmers but may have the biggest effect on retired farmers.

Capital gains is calculated based on the net sale proceeds minus the owners basis in a property. Chart courtesy of Gov. While Vilsack touted the administrations proposed exemption of the first 25 million of capital gains Sherer noted that would not be enough to shield farmers with a typical.

Last year the iowa department of revenue unveiled a new form for claiming the iowa capital gain deduction. Taxes on capital gains have two different rates short-term and long-term depending on how long you held the asset for. Some or all net capital gain.

Capital gains that qualify for the deduction result from the sale of real estate that is used in a trade or business in which the taxpayer materially. An estimate on retirement. - Law info 2 weeks ago Jun 30 2022 The tax rate on most net capital gain is no higher than 15 for most individuals.

How Much Is Capital Gains Tax In Iowa. The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue. Iowa Capital Gains Deduction.

Capital Gains Tax Iowa Landowner Options

Strategies To Manage Your Extra 3 8 Tax

Publications The Tax Implications Of The American Families Plan On Iowa Farmland Owners Card

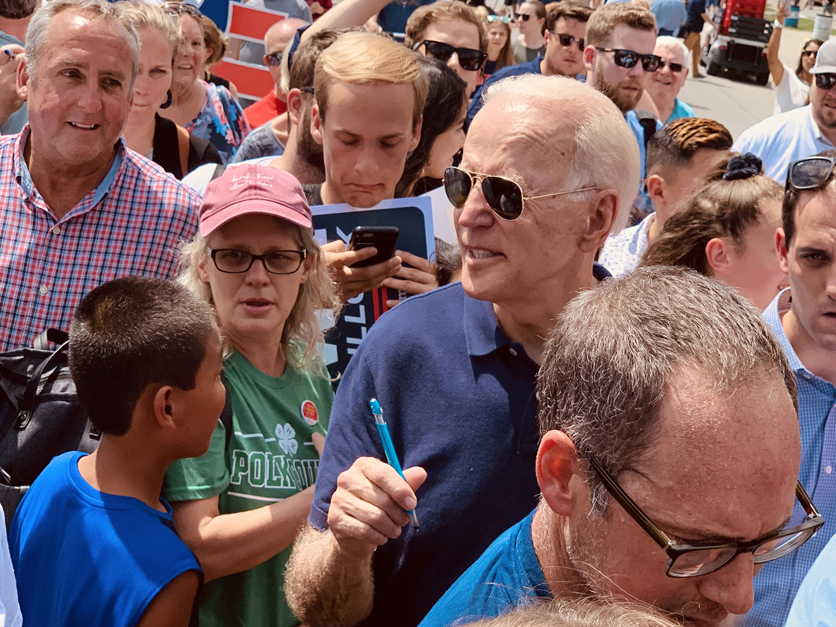

Frontline Farm State Democrats Push Back Against Biden Tax Plan Roll Call

How Will Iowa S New Tax Law Affect Retired Farmers Iowa Capital Dispatch

Capital Gains Tax Iowa Landowner Options

Farmland Sales Jump 12 But Bankers Doubt Gains Will Last

Publications The Tax Implications Of The American Families Plan On Iowa Farmland Owners Card

How Will Iowa S New Tax Law Affect Retired Farmers Iowa Capital Dispatch

Biden S Tax Changes Won T Hurt Family Farmers Wsj

Iowa Supreme Court Affirms That Typical Cash Rent Landlords Not Eligible For Capital Gain Deduction Center For Agricultural Law And Taxation

2021 Capital Gains Tax Rates By State

Farmers Could Be Hit Hard By Some Aspects Of Biden Tax Plan 2020 10 13 Agri Pulse Communications Inc

When Do You Need A Farmland Appraisal Iowa Land Company Blog

Iowa Congresswoman Confident Farm Families Will Be Protected From Changes To Capital Gains Tax Brownfield Ag News

Farmland Sellers And Capital Gains Taxes On Sale Peoples Company

Farmers Worried By Possible New Capital Gains Estate Tax Liability Successful Farming

A Tax Plan Can Mean Multiple Capital Gains Exemptions Manitoba Co Operator